I am incredibly humbled to be elected to serve as president of the AAPS and will work diligently to apply my experience and vision to add value to commercial paleontology and the education of future scientists, business owners and members. We as an organization have a huge responsibility to represent the vast majority of paleo-professionals in a very broad spectrum of businesses and specialties. We have a much bigger collective voice than we realize, and I encourage everyone to find it and use it to change the narrative about "Commercial Paleontology". The reality is we create more jobs and opportunities for researchers and academia than is possible through traditional paths. We cannot look to the past mistakes of our industry and compare ourselves to anyone else. Who we are and what we represent is unique and should be celebrated. Let's look to the future possibilities of commerce and science, the collaborations that will produce groundbreaking research and the future jobs that don't even exist yet. My vision is to see the AAPS lead by example through education, outreach and cooperation. Sincerely Administrative Director's CommentsI hope that everyone made it home safely from the Tucson Shows. I also want to welcome the nearly 20 new members who signed up since the 1st of the year. While we had a wonderful meeting and dinner, I can't express strongly enough, the need for us to find a new suitable location for our annual meeting. Every year, the University has raised the rates we are charged and found new ways to charge us for services. This year, with all the new charges, our bill increased over 45% from $5,360.05 in 2022 to $8,289.00 this year. New charges included a fee for the room's raisers, Appetizers increased by nearly $500.00. There were new service charges added to our invoice, $905.00 in addition to the staff and Bartender fees for our Cash Bar ($289.00). Tablecloth fees raised from $10.00 per table to $12.00 and they now charge us for the auction table coverings $10.00 each ($180.00). It is quite clear that we cannot continue to have our meetings there and keep the meal cost reasonable. So, I'm reaching out to the membership, especially those living in Tucson. We need to locate a facility that can accommodate up to 180 people, with space to display auction items, a registration table/payment table. The facility needs to have adequate parking, allow for a cash bar and can either provide food or allow for catering. Finally, it needs to be within a few miles of the downtown shows. Please contact me if you have any recommendations. Sincerely Loss of Another AAPS Member, Joe David Taylor

Joe David Taylor 78, of Crosbyton passed away peacefully and surrounded by his loved ones on Sunday, March 5, 2023. Joe was born October 2, 1944 in Ralls, Texas to Dennis Delton Taylor and Rachel Mae McClure. For those of you that did not know Joe, he was a dedicated young earther, a creationist and a wonderful prepper, artist, and sculptor. He has been a member of AAPS since the mid-1990s. He loved to argue his beliefs and I was privileged one year in Tucson, along with Bill Mason and Dr. Robert Bakker, to attend breakfast with Joe. While at breakfast, Joe argued with Dr Bakker about the true age of the earth. It was a glorious debate! Joe stayed at our home in Tucson on a number of occasions and we found common ground discussing fossil prep and preservation. I'm sure many of you are familiar with the soft drink Mr Pibb, but you may be surprised to learn that Joe designed the logo for the soft drink before it was introduced during 1972, in the Waco Texas test market. Unfortunately, the museum Joe created "The Mount Blanco Fossil Museum" will be closed by the family and the replicas and original specimens will be sent to museums and sold off. You can read his full memorial on the page "Tributes to Past Members and Friends". If you have time, here is a great tribute to Joe's life on YouTube, https://www.youtube.com/watch?v=WepzXLknG7o Joe's family suggests memorials to Crosbyton Senior Citizens Center, 119 N. Berkshire, Crosbyton, TX 79322; or Lubbock Regional Honor Guard, P.O. Box 447, Abernathy, TX 79311. 2023 Tucson Events

Before the Tucson shows even started, on Tuesday January 24th, Tracie Bennett invited Gary Olson's daughter Crystal Olson and her friend Dennis to dinner at Mr. An's Teppanyaki Steak, Seafood, Sushi & Cocktail restaurant so that she could meet many of Gary's friends. Gary was actually present! The dinner was well attended with over 50 of Gary's friends and acquaintances attending. He will be missed by all knew him. All the shows I visited seemed to be doing well, with parking still a major issue at the established shows with only a few exceptions. The absence of the Gem Show Ride vans again this year made matters worse and needs to be addressed by all of the Tucson Show promoters if it to be reinstated. Our annual dinner was well attended with 170 in attendance, the best year we have had since AAPS first started having these annual dinners nearly 40 years ago.

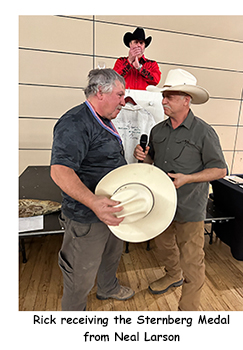

In addition to the Grants and Scholarships, the board approved two Charles Sternberg medals to be presented. The first Charles Sternberg medal was presented to Rick Hebdon, founder, and owner of Warfield Fossils. Rick has served on the AAPS Board for numerous terms and two terms as vice-president. Rick and Warfield Fossils have donated and supplied many museums and institutions specimens from the Green River Formation. Rick has supported our auctions over the years. Warfield Fossils has kept an extensive data base of specimens found in his quarry and offered to make that available on our website. Like other past recipients, Rick was long overdue for this award.

The second, presented posthumously to David Kronen for all his contributions to major museums and university displays over the years since forming Bone Clones in the mid-1990s. He supported many students in the biology and anthropology fields. He supported the AAPS as a board member and Vice -president, for numerous terms. He and Bone Clones have contributed annually to our auctions and supported our grants and scholarships financially with donations. David's wife Gita Kronen attended the dinner as our guest to accept the award for David. I understand that the framed medal will be prominently displayed at the Bone Clones' facility in Chatsworth California. AAPS sponsored our annual Guest Speaker Event hosting Scott Foss, senior paleontologist for the BLM who spoke on the revised section on Casual Collecting on Federal Lands (BLM and Forest Service). This event was open to the public and was attended by about 50 people.

In addition to the AAPS events, Andre Lujan and Chase Pipes held their 5th Annual Rib Off at the Mineral and Fossil Alley Show at the Days Inn. The event started 5 years ago when Andre cooked some beef ribs on the grill by the pool for lunch. Chase pipes commented that they smelled good, but he could cook better ribs and so the first competition was between Chase and Andre to decide who makes better ribs; Tennessee or Texas. Chase won the first contest. The attendance at this event has grown over the years, and I understand there were between 80 and 100 people in attendance to sample and vote on the best Ribs. The event is by invitation, and I understand it is only open to dealers and guests set up at the Fossil Mineral Alley Show. The 2023 cookoff results were: 1st place Bob Finney (Fossil Lake Fish Company), Second Place Chase Pipes (smoky mountain relic room), 3rd Place Andre LuJan (Paleotex), and 4th Place David Guirre (Geofossils) Congratulations to all!  2023 Kemmerer Fossil and Mineral Expo

This coming June, the 2nd annual Fossil and Mineral Expo will take place on Friday June 16th and Saturday June 17th. 9 am until 6 pm both days at the South Lincoln Training & Event Center, 215 Wyoming State Hwy 233, Kemmerer, Wyoming. Their website can be viewed at, https://kemmererexpo.com/ I wanted to share the information on this event and its primary cause of raising funds for the Fossil Basin Institute. The Institute exists to promote public and scientific interest in the natural and cultural history of Fossil Basin, Lincoln County, Wyoming. Its primary mission project is raising funds for the Fossil Depot Restoration Project (the original depot located near the site of Fossil Wyoming). The depot is listed on the National Register of Historic Places. A number of AAPS members also are members of the Institute. AAPS recently applied to become a member of the Institute, because the AAPS board of directors supports the event and the Fossil Basin Institute. The Fossil and Mineral Expo was the brainchild of Institute and AAPS member, Keely Sweeney owner of Fossil Oasis, who currently serves the Institute as their webmaster. A number of AAPS members will have booths at the event and sponsor educational displays as well. Our members that sponsor the Expo (at the time of this newsletter) include American Fossil, Fossil Fish Adventures, Fossil Oasis, Fossil Shack, Geo Tools, Lindgren Fossils, Moments In Stone, PaleoTex LLC, Poozeum, Utah Dump Digger,and Wyoming Fossils. AAPS strongly recommends that all Professional Quarry and Shop Owners in the Kemmerer area join the Fossil Basin Institute and support their programs. If a visit to Kemmerer to collect fossils is on your bucket list, this would be a great weekend and perfect opportunity to come for the Expo, and perhaps visit Fossil Butte Nation Monument, spend sone time at one of the many commercial quarries that allow collecting. Contact me if you would like a list of quarries around Kemmerer that allow collecting. If you would like to display or have a booth at the Expo, email Keely Sweeney directly, kemmererexpo@gmail.com. 10x10 booths for vendors are $120 for both days. Potential Change to the AAPS Code of EthicsIt has come to the attention of the AAPS Board of Directors, that a change to section 1 of our Ethics code is necessary. Because so many AAPS members are selling additional items along with the Fossils they offer, such as artifacts, osteological items, minerals, meteorites, etc, that dealers need to be aware of any international, national, state, and local laws that may restrict certain items. Therefore a recommendation has been made to change section 1 of our code of ethics to read: "1. Strive to stay informed of and comply with International, National, State/Provincial and Local regulations pertaining to collecting activities relating to paleontology, anthropology, geology, and other sciences, as well as general business practices." We will put this to a membership vote because it is part of our Bylaws. Watch for an email when the ballot has been prepared on eballot.com and sent to the membership. The ballot will be open for at least a week allowing everyone to vote. AAPS 2023 Membership Drive Update

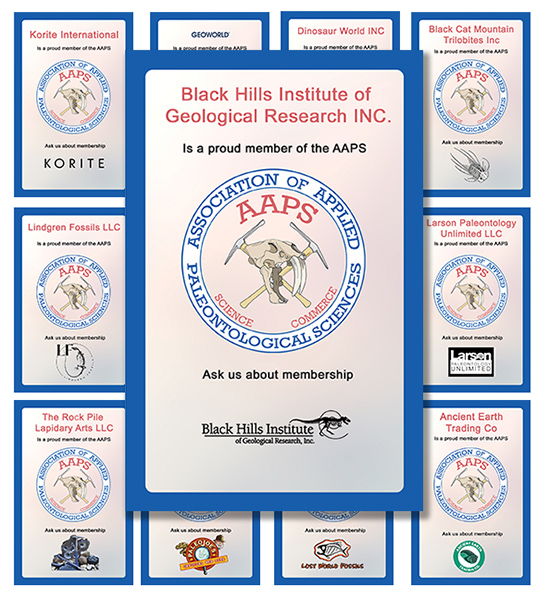

Here is an update on our 2023 membership drive contest. Remember this will end the day we have our meeting in Denver. The following members are gaining a substantial lead and you are invited to participate! Alex Ruger, BHIGR -11 new members. The placards, originally designed by John Issa, are $7.00 each. They are 5.5 inches wide, 8.5 inches tall with a stand attached to the back so the placard can be displayed in or on your display case. Your company name and logo are prominently displayed along with the AAPS logo. Email george@stonejungle.com if you would like to order your Custom Members' Placard and/or a supply of the printed applications with your company name as sponsor. Save shipping costs and ask for delivery in Denver, Kemmerer, or Tucson. I look forward to hearing from you and seeing you at a future show.

|

|||||||||

Sponsored Advertisment

Sponsored Advertisment The Association of Applied Paleontological Sciences, AAPS, is a public charity registered in the state of Utah as a Non-Profit, and with the IRS under section 501(c)(3). As such it is tax exempt for income tax purposes and is permitted to receive tax deductible gifts pursuant to the Internal Revenue Service. It is also able to receive tax deductible bequests for Estate Tax purposes. Donations to any of our scholarships and Grants are totally tax deductible here in the United States. 100% of all Scholarship and Grant donations are used solely for those purposes. Specimens donated for our annual auction may also be deductible, check with your tax and estate planner.

The Association of Applied Paleontological Sciences, AAPS, is a public charity registered in the state of Utah as a Non-Profit, and with the IRS under section 501(c)(3). As such it is tax exempt for income tax purposes and is permitted to receive tax deductible gifts pursuant to the Internal Revenue Service. It is also able to receive tax deductible bequests for Estate Tax purposes. Donations to any of our scholarships and Grants are totally tax deductible here in the United States. 100% of all Scholarship and Grant donations are used solely for those purposes. Specimens donated for our annual auction may also be deductible, check with your tax and estate planner.